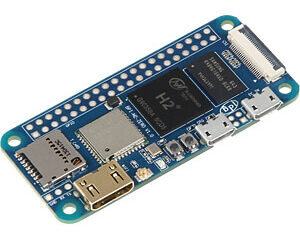

My Banana PI Zero

I liked the Spec of the Banana PI Zero: With it’s quad-core Cortex-A7 it should have more power then the Raspberry PI Zero – it should just have more memory! It is quite easy to set up a Raspberry PI in a way that it starts and automatically connects to the network. So there is no need for any screen or keyboard. I tried to install some of the supported Operating Systems on the Banana Read more…