Quantitative Trading

Will you get rich by investing in Funds ?

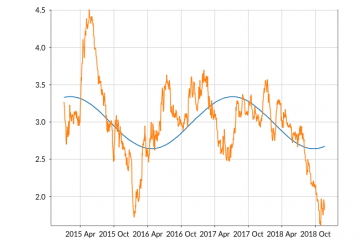

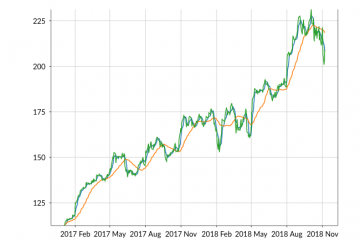

In recent years most banks are pushing their customers to invest in Funds with the argument that this is more profitable than any other option. As always it is valid to question this statement. As a compelling argument an index chart is presented which shows indeed that the stock market was growing! I tried to run some simulations using the data form my Investor framework to validate this statement: Here is the link to my Gist Read more…